10 steps to buy a house in Spain Through Idealista

Have you decided on the big step to buy houses in Spain? Are you wanting to know if you can trust Idealista? Are you wondering where to start? Then you need look no further. If you are a foreigner wanting to buy in Spain, read on for Idealista’s 10 steps to owning your own house in Spain.

➡️ 10 Steps to Buying your Own House in Spain?

Whether you are considering Spain as an investment, or looking to retire or live in Spain permanently, or you just want your own piece of paradise for holidays at a whim where it is sunny and warm, with golden beaches or tranquil mountain vistas?

Are you confused at requirements like an NIE, or escritura de compravento? Or are you just feeling frustrated at how to find yourself a property and make your way through the process? Then check out what Idealista has to say in their How-To in 10 easy steps.

👉 Can Foreigners Buy Property in Spain?

With the skyrocketing prices of home ownership making this unrealistic in so many countries around the world, plus the cold and wet winters, more and more are becoming sunseekers in places like Spain. Following the drop in housing prices with the global financial crisis and post-Covid pessimism, the property market has stabilised and is now gaining as a great opportunity for foreign buyers.

Spain is welcoming foreigners wishing to buy into their market, with the legalities and practicalities being relatively streamlined for foreign buyers. Expats buy and sell upwards of 70,000 houses in Spain every year, making a significant impact on the market.

Here are 10 Steps to purchasing your own home in this sunny paradise.

- Find an Agent like Idealista to guide you through the process

- Apply for your NIE (Spanish Identity Card)

- Mortgage Groundwork and Open a Bank Account

- Find your House

- Surveys and Property Condition and value checks

- Hire Legal Specialists

- Make an Offer and your Downpayment to secure your choice of house

- Mortgage Arrangement – Collect your documents

- Sign the Deed and Pay for final transfer of ownership

- Post-Purchase Care

▶ Step 1: Find an Agent

Of course there are plenty of real estate agents in Spain, with a healthy local market and 80% of the Spanish owning their own homes, often mortgage free. But as an expat the language issues and cross- cultural housing market differences make this a minefield of difficulties.

The first step – even before looking for your new home – is to find an agent who understands the expat market and looks after all the details, including language difficulties, legalities, and those aspects which are unfamiliar, irrespective of which country background the expat buyer comes from.

There are several agents who specialise in streamlining the process for foreigners, but Idealista is arguably the biggest and the best of these. They are experienced realtors with an extensive listing of properties all over Spain, but especially in the areas most popular with foreign buyers. They also extend the normal services to cater for a number of extra needs which are unique to the non-Spanish purchaser.

Visa and relocation information, renovations and post purchase property management are just some of the services which are offered and might be needed when buying across borders in unfamiliar territory. Idealista understands these needs, and has available English-speaking staff (and other languages) who have expertise in all these areas, as well as extensive resources and contact information to direct property buyers easily, saving a great deal of frustration in struggling with language and unfamiliar procedures.

▶ Step 2: Apply for your NIE

As is the case everywhere including for the Spanish in Spain, ID is essential for anyone living in Spain, buying a property in Spain, for opening a bank account or all legal and financial dealings, or functioning professionally and even socially – for anything more than as a passing tourist. For the non-Spanish, this means an NIE number – Número de Identificación de Extranjeros.

This number can be applied for in Spain, or at the Spanish embassy in your country. Even the Spanish and EU citizens will have an NIE number, and for them it is usually processed on the same day. For the rest it may take a few weeks. The good news is that the NIE is for life – you only need apply once and never needs renewing. The process is also not difficult. As a foreigner, the process will need documents such as:

- Passport

- Proof of eligibility

You will need to visit a police station with your passport, by appointment. One near your chosen area for property purchase is best, but it can also be done via a Spanish embassy if you’re not able to be in Spain. Staff at Idealista can help with the information you need in order to gain your financial ID number and the process for it, or you can confirm it for yourself by consulting the site for the Ministry of Foreign Affairs.

▶ Step 3: Groundwork for Mortgage and Open a Bank Account

As part of your plans, now is a good time to make sure that everything is feasible. Making sure you have the finances is perhaps the first step. What is your budget? Remember to take into account those additional fees. Allow for an additional 10-12% of the sale price in taxes and fees.

Idealista has experts who understand the banking system in Spain, especially where it applies to the financing of homes by foreigners. They can direct buyers to banks such as CaixaBank, Banco Sabadell, BBVA, Banco Santanda, depending on their specific needs. This is the time to discuss your mortgage needs with banks.

Once you have a viable mortgage option with a bank, open a bank account with them. From the UK and 14 other EU nations you can even do this remotely.

Otherwise you can discuss bank transfer arrangements to pay for your property from outside Spain. Wise is one which may have smaller exchange fees to facilitate this process. But a bank account is needed for the payment of taxes and fees on your property purchase.

Another possibility if you can’t get to Spain is to arrange a power of attorney. For this you will need:

- A certified, colour copy of your passport or ID (eg an apostille stamp)

- An official translation into Spanish

- Tax Identification Number (TIN)

- Proof of economic activity

- Income statement

▶ Step 4: Find your House

Now the real fun starts:- looking for your new house!

While it is possible to purchase without viewing, this is generally not a good idea. Photos don’t show everything. Remember, the seller will show their property to its best advantage. For somewhere you plan to live, you need to understand the good and the bad, to see for yourself how your lifestyle might fit into it.

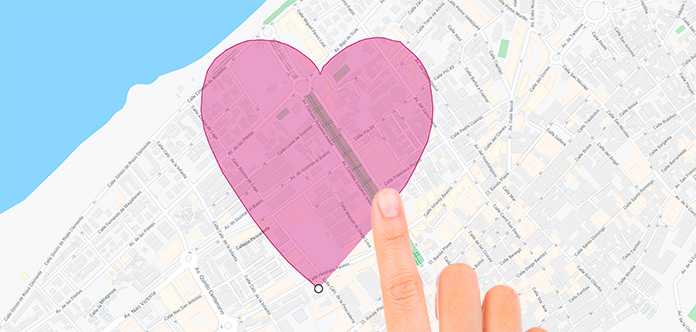

But there is a lot you can do beforehand if you can’t be in Spain for very long. You can use a site like Idealista to screen the ones you are interested in, checking photos and google maps for the things that matter to you. Most will now have a virtual video. Make your list and arrange your visits in the space that you have. Just be mindful that if your time is very short, you may not be successful, especially if you have a big list of must-haves.

Take time to think through your life and needs, and to check out those details. How convenient are supermarkets and schools? What might be involved in changing something that you want to fix? The best way to make a better choice is to be renting in an area while you look. This way you can start to get a feel for the place. You may realise that the one which has the amazing views would get frustrating for town access, or that another which seemed suitable is on a very noisy street or part of town.

▶ Step 5: Surveys and Property Condition

Before making an offer, there are a few things you need to confirm in order to settle on a fair price. Make your offer through your realtor, like Idealista. This will usually be done verbally to start with, then in writing for the notary. They will guide you through this process.

But first, you should do a survey, and ask for the Nota Simple. It covers official information about the property, including:

- Previous ownership

- Property description and usage classification

- Debts – which are carried with the sale and for which you will be responsible

- Boundaries

- Community costs

- Details such as roads and water arrangements.

The property may appear to be your dream come true, but if there are fundamental foundation problems, for example, your dream can very quickly turn into a nightmare money pit of frustrations. A survey will clarify these things.

Arrange for inspections with Idealista and go to Spain to look at your chosen house in person. Remember to take into account whether that beautiful mansion with an infinity pool is nowhere near the night scene you love, or the schools or shops that you need. If the problem is that it doesn’t have a practical kitchen or bathroom or bedroom that suits you, make sure the changes you need to make are within your budget, and practical in the Spanish economy.

It is always smart to check everything and make sure there are no hidden problems. There are two kinds of surveys:-

- A Valuation Report which is a guide to the market value of the property

- A Building Survey assesses the structure and condition of the property and will indicate if there are any major issues, things which may not be evident from a walk through inspection.

If significant work needs to be done, you need to take this into account with your offer. If it is something small but important, you need to make sure that you have the budget for the extra. Even if it is clear that a house needs renovations, make sure you know beforehand how much they are likely to cost. You will need to be sure that you have the budget to cover it all.

▶ Step 6: Hire Legal Specialists

Now it is time to hire those legal specialists to guide you through the signing of anything which is legally binding, things outside the realm of the realtor, that Idealista is not qualified to do. The rules will be different to your own country. There may be some requirements which are specific to Spain, and others you might expect but are not necessary in Spain.

You need a lawyer registered with the local bar association Colegio de Abogados. Theycan be found at Abogacía Españolawhich is a national website.They will know everything needed for purchasing a property in Spain.

You will need a lawyer for the legal paperwork, and to ensure that everything is completely above board and legal. For example, in Spain, any debts connected with the property will be passed onto you with the sale. Checks might include:

- A Property Register – checks for legal owner and any encumbrances.

- Planning – checks that building codes were followed.

- Tax and Community – that property taxes and community payments are up to date.

You will also need a notary for things such as official paperwork including translations, and to check transactions and taxes are properly paid. After purchase, you will be responsible for property registration, for examples. A notary can take care of these things for you.

▶ Step 7: Make an Offer and your Pre-Contract Downpayment

Once you have the legal aide you need and the sale price has been settled on, you as the buyer needs to sign a preliminary contract – contrato privado de compravento. This document will set out the terms and conditions and fix a date for the sale to be concluded. If fixtures and fittings or furniture are included, these should be itemized in the pre-contract. This cooling off period can vary, but will often be from 10 days to 8 weeks. Idealista will guide you through the process.

It is also time to pay a deposit to secure the property as a promise to purchase. This will usually be around 10% of the agreed price. Be aware that in the unlikely event that the sale doesn’t go through for reasons beyond the seller’s control, you might lose your deposit. If, on the other hand, the seller chooses to withdraw, they are required by law to pay you double. So generally, this is a confirmation of the sale.

▶ Step 8: Mortgage Arrangement

Make sure you have factored in the mortgage application time to fit within the agreed timeframe on the pre-contract. There are non-resident mortgages, for those who are in Spain for less than 183 days in a year. However, being permanently resident is likely to offer better mortgage options, and you are likely to be able to borrow as much as 80% of the property’s value (as compared to 50-70% as a non-resident).

You will need to collect the documents required by your bank so they can fully assess your financial situation. Make sure you have specified the outcome in your pre-contract should your mortgage not be approved.

Documents which the bank may require could include the following:

- Valid ID, including NIE and passport

- Employment details, salary and tax income statements

- Bank account statements

- Marriage and birth certificates

- Deed of the sale

When it comes time to sign the deed, both this and the mortgage arrangement will need to be signed in the presence of a public notary.

▶ Step 9: Sign the Deed and Pay

The final moment has arrived! In the presence of a public notary, it is time to sign the contract of sale (escritura de compravento). The mortgage papers are also signed at this point, and the final payment, including all taxes and other fees accrued are due. This should come with a verbal translation of everything as your lawyer checks over the details on your behalf.

If for any reason it is impossible for you to be there in person, you can set up a power of attorney so that someone else can finalise all these details for you via Idealista.

The bank draft is processed, and the property is now your home and you will receive the keys. Your notary can then register your new home in your name at the nearest Registro de la Propiedad. They can then pay the required taxes and fees for you.

All the utilities can now be transferred into your name, and connected up to your home, and ongoing bill payments set up through direct debit via your new bank.

▶ Step 10: Post-Purchase Care

All is now completed. You have your house in Spain, and you can begin your new life. Realtors like Idealista don’t finish with the sale. They also offer ongoing services to help here.

Renovations

In most cases there are at least a few things you might want to change as a new owner. This can be anything from a few small changes up to major renovations to turn your new house into the home of your dreams. Idealista can help with connecting you to suitable contractors, planning permissions you may need, and give you information on any legalities you may need to be aware of.

Property Management

If you have bought your property to let out, Idealista can manage your property for you as a rental. They can take care of finding and monitoring tenants, taking care of the rental payments, and of any of those maintenance needs which can come up from time to time.

Even if you don’t choose to rent out your property, but you are away for extended periods of time, they can also monitor and deal with maintenance of your property while you are away.

Removalists

You may be simply in need of help with the mechanics of moving overseas. Idealista can supply recommendations for overseas removal companies.

Insurance

It is highly recommended that you take out insurance policies on your purchase. This should be for both building insurance – insuring the actual buildings and all fixed features such as walls and ceilings – and contents insurance – covering your household goods and everything moveable against loss. You can even cover yourself for any damage or harm to any third party. Idealista can recommend some reputable insurance companies.

Spanish Residency Visa

Idealista can also help with residency visas, such as the coveted Golden Visa. While EU residents have far fewer requirements, it is also possible as a non-EU resident to gain a Golden Visa, smoothing your journey into your new dream location and giving you access to the EU and Schengen countries.

❓ FAQ

What are the major costs of buying a property in Spain?

You can expect to add from 8-12% of your property value in sundry costs in the process, and fees to your real estate agent such as Idealista. These include:

- Transfer Tax – 6-10% of value of property

- Title Deed Tax, Land Registration and notary costs – 1-2.5%

- Legal fees – 1-2%

- Fees to realtor – usually around 3% of final price

Does Idealista have post purchase help?

Yes, Idealista offers a range of support services which are available after the purchase has been finalized. These include contact and recommendations with contractors for renovations, and property maintenance if you are absent for extended periods of time. They can arrange rental contracts to keep your property tenanted, as well as recommendations for overseas removalists, Golden Visas for residency, insurance and other needs which can come up following the finalization of your purchase.